Types of Credit and How They Affect Your FICO Score

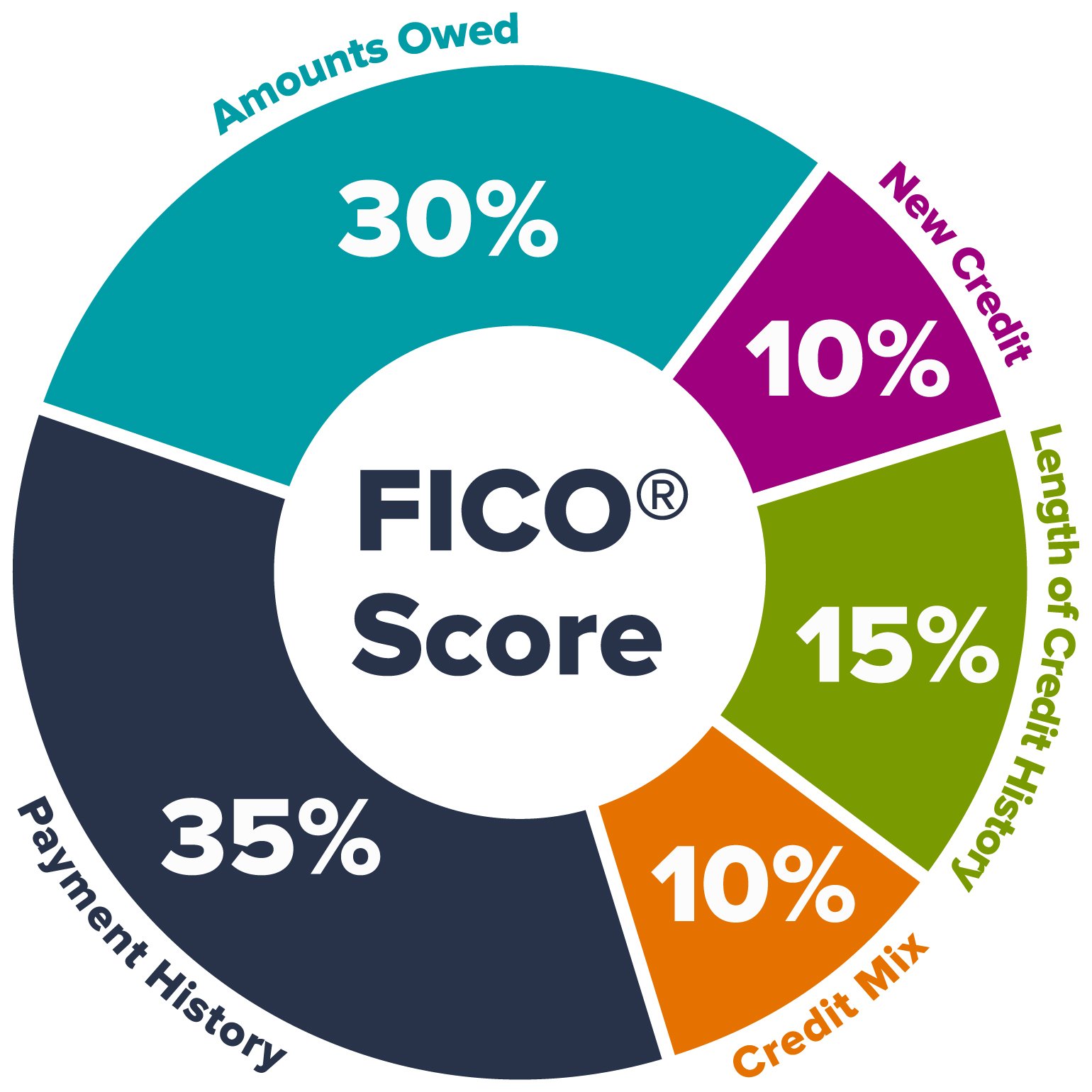

The two major scoring companies in the U.S., FICO and VantageScore, differ a bit in their approaches, but they agree on the two factors that are most important. Payment history and credit utilization, the portion of your credit limits that you actually use, make up more than half of your credit scores. Focus your attention mostly on those two while keeping an eye on the other factors. Instead, take the time to understand what credit mix means and how it influences your score. Here are the kinds of revolving and installment credit accounts that do and do not factor into your credit mix, according to Experian.

Types of Credit Accounts

Increasing the amount owed to a credit issuer bumps up a user’s credit utilization ratio, the total amount of credit card debt owed compared to the total amount of available credit at a given time. The credit utilization ratio likely affects credit scores even more than credit mix. This one factor dictates about 30% of your FICO® credit score — way more than your credit mix alone. You may find that all of the credit accounts you have reporting are revolving accounts. Perhaps you recently paid off a car loan or student loan, or you didn’t use student loans and haven’t bought a car. Installment loans are loans with a fixed amount and regular payments.

- When reviewing your credit report, there should be a section that indicates your different credit accounts.

- The Experian Smart Money™ Debit Card is issued by Community Federal Savings Bank (CFSB), pursuant to a license from Mastercard International.

- Once you get going, however, try to avoid taking on more debt than is necessary just for the sake of building credit.

- Lenders assume if you can manage a mix of credit types consistently, you’re less likely to default.

- If you don’t use an account, keep it open and make occasional small purchases to maintain a positive impact on your credit history.

Credit diversity makes up 10% of your FICO score. So, what is it?

The ability to successfully manage multiple debts and different credit types tends to benefit your credit scores. Credit scoring systems favor a mixture of installment debt (such as student loans, mortgages, car loans and personal loans) and revolving accounts (credit cards and lines of credit). That’s why it’s especially important to keep an eye on your revolving credit accounts. Plus if you pay your balance on time and in full each month, you likely won’t have to pay any interest.

How we make money

And it’s free and available to everyone—even if you’re not a Capital One cardholder. Typically, a good credit mix includes a variety of different types of credit. If you use them responsibly, you show lenders that you can handle a variety of different credit accounts. There’s no such thing as an ideal credit mix for an excellent credit score, but at a minimum, you’ll want to have at least one type of revolving how does credit mix affect credit score credit and one type of installment credit. Factors that affect your credit scores are weighted a bit differently by FICO and VantageScore, but “mix of credit types” is one of the least significant factors. Credit mix is one of several factors that affect your credit score, and credit scoring companies FICO and VantageScore both consider it to gauge how you’ve handled different types of credit.

Is It True You Should Carry a Balance on Your Credit Card?

A credit mix refers to different types of credit, like credit cards and loans. A balanced credit mix shows lenders that you can handle various types of debt and makes up about 10% of your credit score. While having a diverse credit mix can demonstrate your ability to handle a variety of financial obligations, it’s not enough on its own to guarantee a good credit score. You also need to make sure that you make payments on time, avoid taking on too much debt, and maintain a low credit utilization ratio. Credit mix refers to the types of credit accounts you have under your name.

Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you’ve used credit. Understanding what factors affect credit scores helps you plan the most effective way to build your credit or protect it. Understanding the factors that go into credit scores can help you recognize the connections between your behaviors and your scores.

For example, if you have three credit cards with a combined limit of $10,000 and your balance is $6,000, your utilization rate is 60%—which is too high. Not having a good credit mix may hurt your credit score to some extent, but it’s not necessarily a deal-breaker. Credit mix is just one of many factors contributing to your credit score, and its impact may vary depending on your overall credit profile. The calculations that produce credit scores are closely kept trade secrets, but the underlying factors they consider (as well as how they’re weighted) are public knowledge. The following factors and percentage weightings apply to the FICO® Score, which is used by 90% of top lenders.

Other factors, such as our own proprietary website rules and the likelihood of applicants’ credit approval also impact how and where products appear on this site. ADVERTISER DISCLOSURE CreditCards.com is an independent, advertising-supported comparison service. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear within listing categories. Other factors, such as our proprietary website’s rules and the likelihood of applicants’ credit approval also impact how and where products appear on the site. For example, if you only have revolving credit, consider supplementing it with installment credit by taking out a small personal loan.

Links to other websites found on the PrimeWay Federal Credit Union website are provided to assist in locating information. Be aware that privacy and security policies may differ from these practiced by PrimeWay Federal Credit Union. How it can affect your credit is essential to achieving and maintaining a good score. If you have a limited inflow of cash, taking out a loan could put you in a tight spot.

At PrimeWay, we provide members with a suite of online & mobile banking tools to ensure you can always get to your money – wherever you are. You may want to also consider signing up for a credit monitoring service that helps you track your score and activity. Our top-ranked ones include CreditWise® from Capital One as the best overall free service and IdentityForce® as the best overall paid service.

However, you don’t have to take out a mortgage to get some installment credit on to your credit reports. Passbook loans function much like secured credit cards, being backed by your funds. A common misconception is that credit repair is the solution for those with high credit card debt. Credit repair companies often offer to help improve your credit score by working on your report, but the truth is, paying down your debt is a more effective strategy. However, if you only have credit cards and no other types of credit, having multiple credit cards may not significantly improve your credit mix.